Are energy upgrades worth it to grocers?

By Jonathan Tan, VP Energy Services

The AMS Group, Hillphoenix

Food retailers inherently know reducing energy consumption reduces operational expenses and boosts the bottom line. Few, though, have a clear picture of the industry’s energy profile and the magnitude of savings to be realized by strategic energy upgrades. Without taking on the additional role of energy manager, this information isn’t readily transparent. Neither is knowing which upgrades make the most sense and how they justify the expense.

Each dollar cut from the electric bill is equivalent to increasing sales by $18.

According to the U.S. Department of Energy, every dollar saved in electricity has the same impact on a food retailer’s bottom line as an $18 increase in sales.* Ninety percent of electricity consumption is accounted for by refrigeration (56%); lighting (22%); and cooling, space heating, and ventilation (collectively 12%).

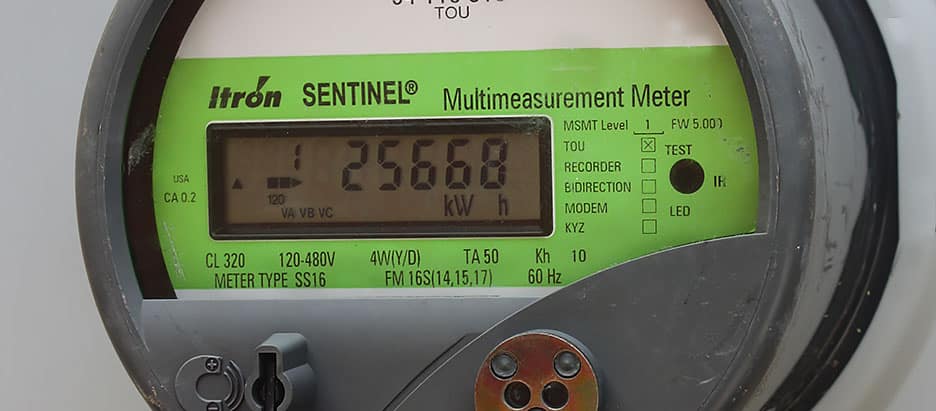

What does this look like in dollars? The DOE reports the average electricity usage for supermarkets is 51.5 kilowatt-hours per square foot. Using a cost of 11 cents per kilowatt-hour, the annual spend on electricity for refrigeration, lighting, and HVAC in a 50,000 square-foot store would be $256,274.

Upgrades in refrigeration and lighting offer the best payoff.

Refrigeration and lighting not only make up the lion’s share of total electricity use, they also affect operations of the HVAC system. Done strategically, energy upgrades in refrigeration and lighting in that same 50,000 square-foot store can cut the annual spend in these areas by as much as 44 percent. When taking the HVAC systems in account, total store savings could be 47 percent or more.

In your own stores, savings would of course depend on such variables as climate zone, condition of existing equipment, and store size, among others. Nevertheless, there are six key upgrades that should be considered in any energy-reduction effort.

- Door retrofits for open cases. Savings are realized through reduced refrigeration load and total power load. In a typical 5-deck dairy case, for example, annual savings can be up to $97 per foot.

- SweatMiser retrofits. Anti-sweat heater controls monitor temperature and humidity in the store and pulse door heaters as needed to control condensation. Potential annual savings is more than $60 per door.

- LED lighting retrofits. Replacing fluorescent lighting with T8 LED lighting offers potential savings of more than $16 per lamp in electricity and maintenance over the course of a year.

- Low-heat door retrofits for freezers. Compared with heated doors, the higher R-value of low-heat doors could save as much as $114 per door per year.

- Fan motor upgrades. Replacing evaporator-fan motors in walk-in coolers with electronically-commutated motors, or ECMs, could save $100 per motor. For refrigerated display cases, the switch from split capacitor motors to ECMs can save $39 per fan.

- Store recommissioning. Over time incremental adjustments made to refrigeration, lighting, and HVAC systems to maintain food-zone temperatures, optimal general and merchandising illumination, and a comfortable store environment can cost far more in energy than maintenance and repairs to address underlying issues.

Hillpheonix’s AMS Group provides turnkey solutions that optimize energy efficiency and performance in all of these areas. Going back to our example of the 50,000 square-foot store, these solutions may reduce a store’s total energy by as much as 47 percent, equating to more than $120,000 in annual savings. To realize that same benefit to the bottom line through sales, customers would need to buy a hefty – additional – $2.2 million in groceries.

Learn more at www.hillphoenix.com/energy-lock

*It’s often cited that saving $1 in energy is equivalent to increasing sales by $59. While the DOE has reported that equivalency in the past (see the ENERGY STAR Building Manual), the value has recently been revised to an $18 increase in sales.